Tech

Chipmakers urged to leverage AI edge in tackling uncertainties

|

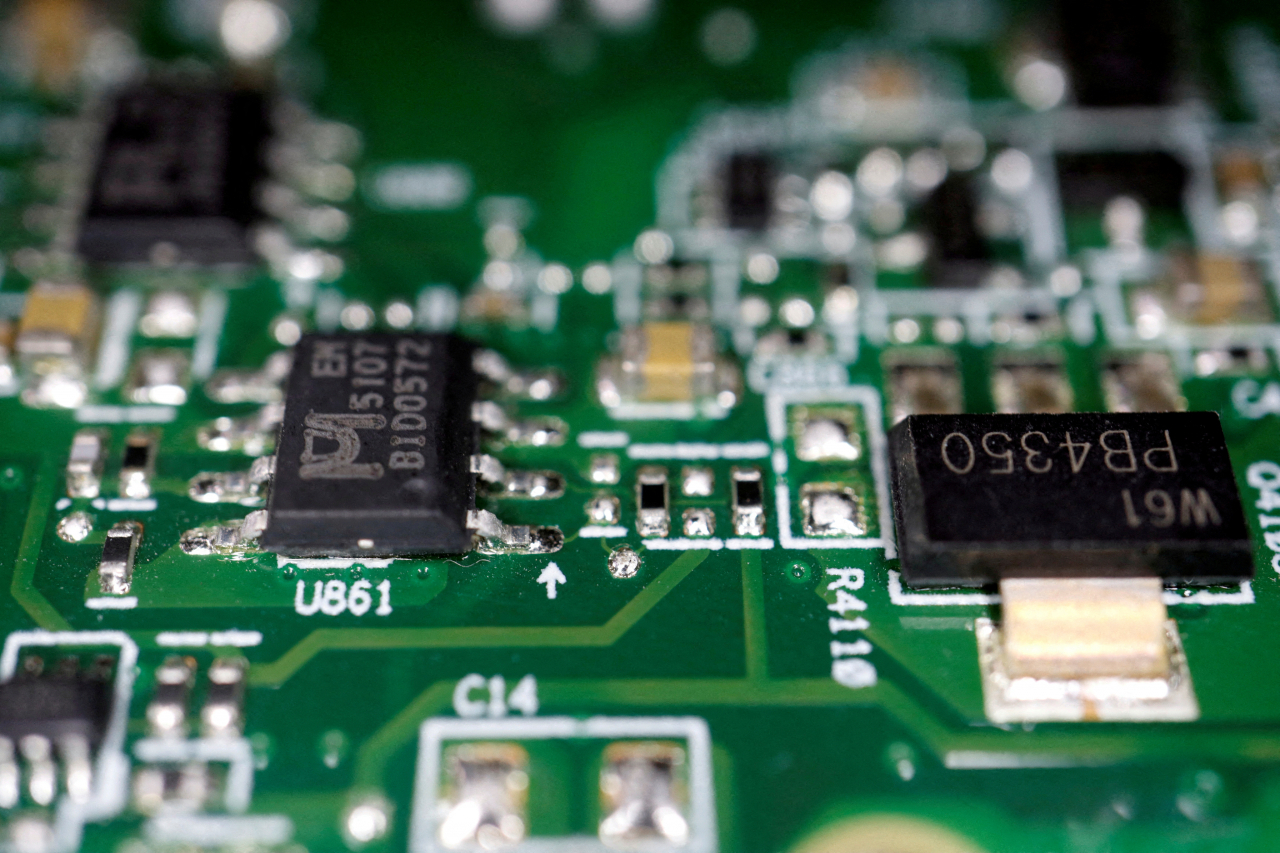

Semiconductor chips are seen on a printed circuit board in this illustration picture taken Feb. 17, 2023. (Reuters-Yonhap) |

Donald Trump's second presidency is unsettling the chip industry globally, after the outspoken leader had publicly threatened during his campaign to cut subsidies for chipmakers and raise tariffs on foreign firms.

South Korea, home to the world’s top two memory chip-makers, is no exception. Experts suggest that Korea should leverage its strengths in artificial intelligence chips and further bolster ties with the new US administration.

One of the imminent concerns is the possibility of the Trump administration repealing the predecessor's CHIPS and Science Act, aimed at attracting chipmakers to build advanced chip factories on American soil by providing billions of dollars of federal funding.

Trump has called the act "so bad," and insisted that imposing tariffs is the way to push companies to build chip factories in the US, rather than via federal subsidies and tax credits.

If Trump undertakes the process of repealing the CHIPS and Science Act, it could deal a major blow to Samsung Electronics and SK hynix, which are currently building chip factories in the US and awaiting grants promised by the US Commerce Department for their significant investments.

Under the Biden administration, the US Commerce Department promised Samsung Electronics up to $6.4 billion in funding for the chip giant's construction of a $45 billion chip foundry facility in Taylor, Texas. SK hynix is waiting for up to $450 million of federal subsidies for its investment of $3.87 billion to build an advanced chip packaging plant in Indiana.

Given Trump's critical remarks, analysts predict he could attempt to repeal the bipartisan CHIPS Act. Others believe Trump would likely attempt minor changes, such as reducing the amount of subsidies or changing the workforce requirements for the ongoing projects.

"There is a possibility for the Trump administration to propose new terms of negotiation to chip firms related to granting the promised subsidies. It may ask companies to invest more to receive the funds, or reduce the amount of the benefits," the Korea Institute for Industrial Economics and Trade said in its report.

|

Republican presidential nominee and former US President Donald Trump takes the stage to address supporters at his rally, at the Palm Beach County Convention Center in West Palm Beach, Florida, US, Wednesday. (Reuters-Yonhap) |

Lee Jong-hwan, a system semiconductor engineering professor at Sangmyung University, predicted it is unlikely for the president-elect to scrap the chips program in its entirety, as it aligns with his goal to strengthen American chip manufacturing.

"The CHIPS Act did succeed in attracting global chip facilities on US soil, and will create jobs," Lee said. "Trump is an unpredictable figure so it is hard to predict, but he would be aware of the benefits of the CHIPS Act for his country."

Trump's envisioned universal tariff policy and decoupling strategy to isolate China from the global supply chain is expected to have both benefits and challenges for Korean chip firms, experts say.

While China has been seen carving out its share in the legacy memory chip market in recent months, Trump's decoupling measures would likely put a damper on its progress -- allowing Korean chipmakers to maintain their share of the market.

Tariffs would raise overall chip prices and could weaken demand, but Korean chipmakers could benefit in the long term when Trump's high tariffs on chips made outside of the US force companies to produce chips on American soil, according to Park Jae-geun, a professor of electronic engineering at Hanyang University.

TSMC, the Taiwan-based foundry producing some 80 percent of the world's cutting-edge chips, stands as the favorite chip manufacturer for global tech giants. While the company produces a majority of advanced chips in the world from its fabs in Taiwan, it will not be able to satisfy all the demand from the two factories it is currently building in the US, Park explained.

"So the chance would go up for Samsung to bag the rest of the foundry orders that TSMC cannot take," Park said, adding that it will be an opportunity for the tech giant to boost its footing in the foundry market where it stands a distant second after TSMC.

Risks remain for Samsung and SK hynix, which rely on China for chip sales. They may also face difficulties in operating their chip manufacturing facilities that produce a large portion of their memory chips.

The Biden administration implemented a sweeping set of regulations to ban the export of certain semiconductor chips made using US technology and advanced chip equipment to China in 2022. For the two Korean chipmakers, the US has granted waivers allowing them to import tools without having to apply for a license.

Under Trump, the Korean chipmakers may have to go through complex processes to apply for the license.

In order to mitigate risks and gain negotiating power with the Trump administration, Korea should leverage its technological edge in high-value AI chips, experts said.

"The paradigm in the chip industry is shifting fast toward high-value AI chips. Whatever Trump does, Korean companies hold an edge in AI memory chips that are high in demand, and this should be their negotiating power," Lee of Sangmyung University said.

Park echoed Lee's view, noting how the US would not want to strain relations with Korea when it aims to gain dominance in the AI industry.

"US has major players in the AI sector, like Nvidia, Intel, Google and Apple. These companies need Korea's AI chips, such as High Bandwidth Memory and CXL for advancement," Park said.

"Technology is the negotiating card. The Korean government and chipmakers should work together to persuade the Trump administration that we are the critical partner for its AI advancement."

By Jo He-rim (herim@heraldcorp.com)