Economy

[OIL IMPACT] Oil price drop fuels deflation concerns

[THE INVESTOR] With crude oil prices dropping to a four-month low, concerns are growing that South Korea could soon face deflation.

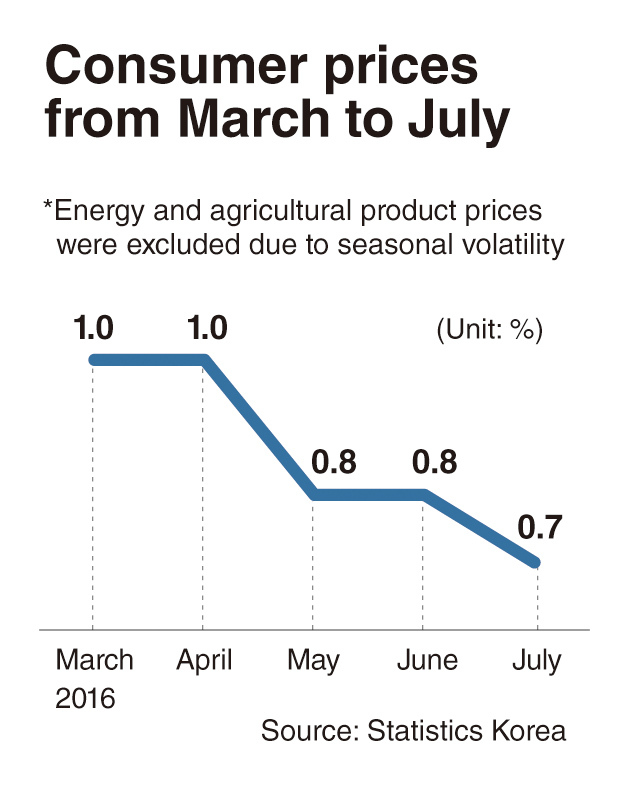

Official data suggests that the country’s consumer prices have grown at worrying rates this year.

|

According to Statistics Korea, July saw the lowest on-year increase in 10 months, coming in at 0.7 percent. With the July figure coming in at 0.7 percent, South Korea’s consumer price inflation came in at below 1 percent for the consecutive month. The statistics agency said that falling prices of petroleum products, lowered by dropping international crude prices, weighed on the inflation rate, dragging down overall consumer prices by 0.38 percent.

See also: KOSPI falls below 2,000 level for first time in 2 weeks

Meanwhile, recent developments are in stark contrast to the Bank of Korea’s projections. The central bank had projected that the rate of consumer price increase would surpass the 1-percent level in July, saying that oil prices would recover.

|

As recently as July 29, the BOK had predicted that international oil prices will slowly recover in the coming months. In its monetary police report, the BOK said that “inflation rate would rise in 2017, aided in part by recovering oil prices, saying that concerns for oversupply would dissipate.”

However, OPEC’s output came to a record high in June, and is estimated to have risen further in July. Based on a recent survey, Reuters reported on July 29 that OPEC output may have reached 33.41 million barrels per day in July, up from 33.31 million barrels in June.

By Choi He-suk (cheesuk@heraldcorp.com)